Having trouble following the topic of discussion when someone throws out the words “Camarilla Equation” at your local trader happy hour? Relax. I’ve got a quick primer for you that will remove the cloak of secrecy from this fascinating price-based indicator.

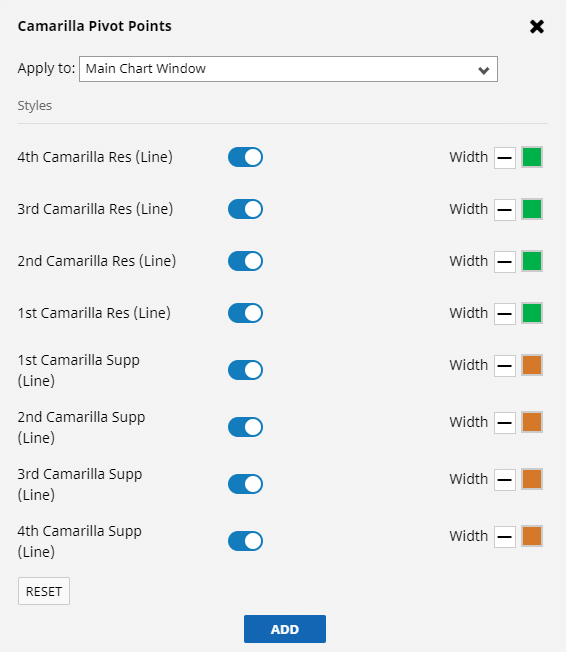

Simply put, the Camarilla Equation is a price-based indicator that provides a series of support and resistance levels, much like the Floor Pivots indicator. However, what makes this indicator unique is the fact that each pivot carries a specific call to action. That is, this indicator is usually color-coded to indicate whether you should buy or sell at certain pivot points. We’ll get to this in a moment.

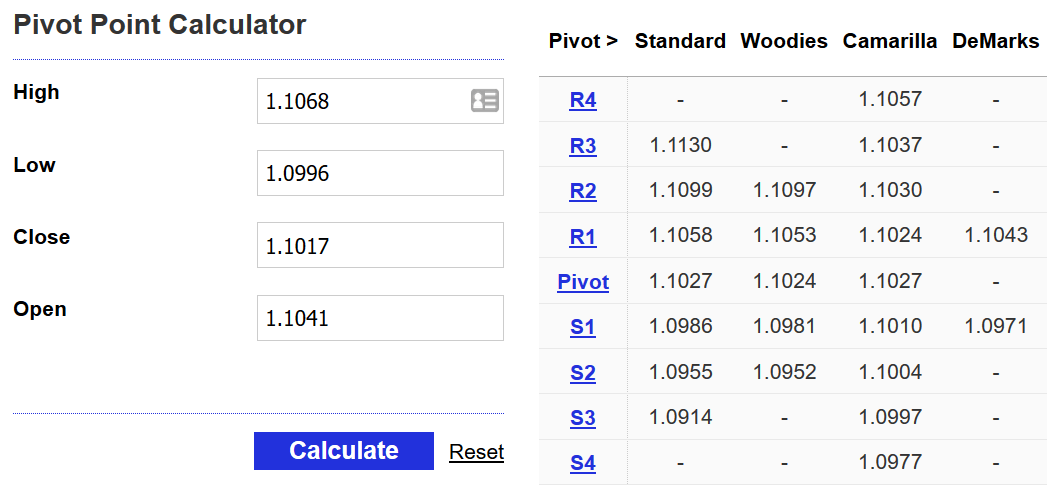

The equation takes the prior day’s high, low, and close prices to determine ten key levels on your charts; five support levels (L1 to L5) and five resistance levels (H1 to H5). The equation is as follows (keep in mind that RANGE is the high price minus the low price of the prior session):

Camarilla Advanced Calculator Formula

Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Camarilla equations are used to calculate intraday support and resistance levels using.

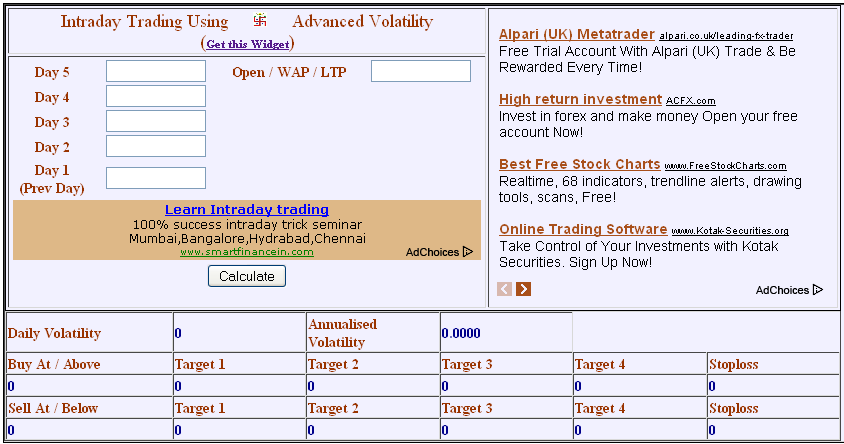

- How to use advanced camarilla calculator (only for intraday) 1. To use this system, you must enter the high, low and close for the previous day. You will also need to enter today's Open price or weighted average price (WAP) 2. Once done, click the calculate price button, you will get both buy and sell signals.

- Camarilla indicator, also known as Camarilla pivot points, draws precise support, resistance, target and breakout levels for intra-day trading.Taking yesterday’s price High, Low, Open, and Close points, Camarilla indicator calculates 11 levels. 5 “L” low levels, 5 “H” high levels, and a middle Pivot point.

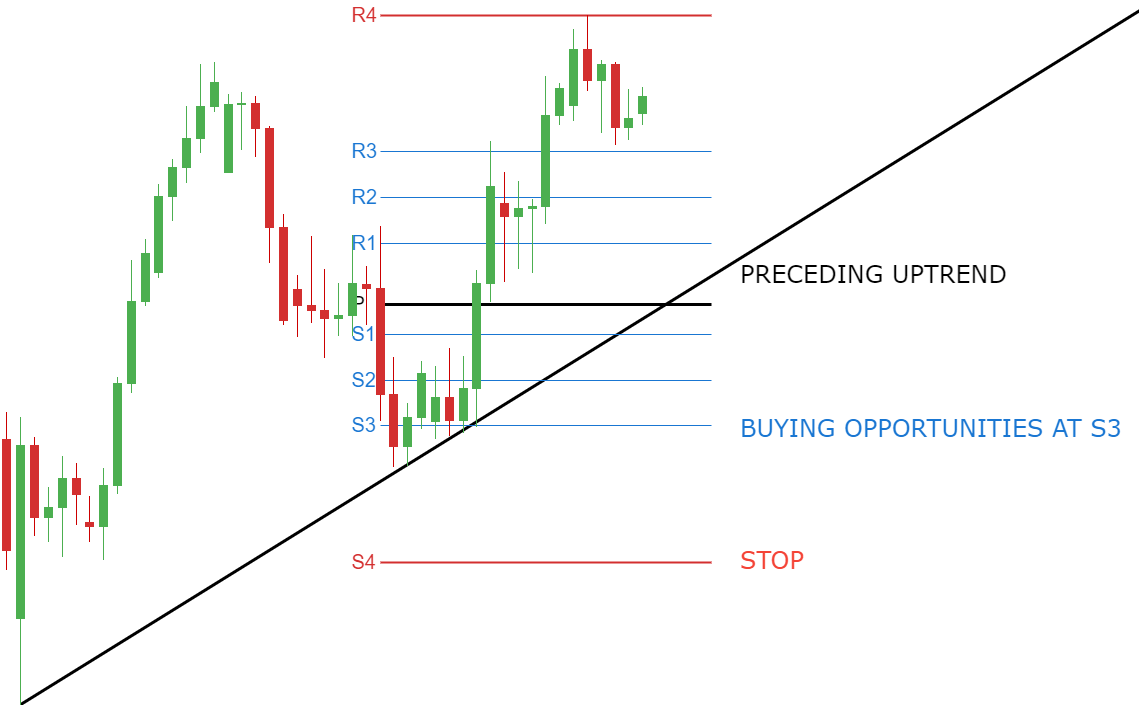

- Camarilla Pivots Calculators. Camarilla Forex pivot points are based on the idea that price has a natural tendency to revert back to the mean, or the previous day's close.

The Camarilla Equation offers a powerful method of trading the market because the call to action is always the same. The equation forces you to recruit your inner discipline to trade on the right side of probability. Traders take similar positions at each level, thus creating a powerful form of self-fulfilling prophecy. Moreover, the pivot levels in the indicator are usually color-coded to remind you which actions to take when certain pivot levels are tested. For example, the H3 and L4 pivot levels are typically colored red because these are the zones where you should be looking to sell the market. Likewise, H4 and L3 are typically colored green to indicate long action levels.

If you take action at the third layer of the indicator (ie: sell at H3, or buy at L3), your target then becomes the opposite pivot point. Therefore, if you sold at H3, then L3 becomes your target. If you bought at L3, then H3 becomes your target. In essence, the third layer of the indicator is usually reserved for reversal plays.

The fourth layer of the indicator (H4 and L4) is usually reserved for breakouts, although these levels can offer razor sharp reversal opportunities as well. If you play a bullish breakout through the green H4 level, then H5 becomes your target. If you play a bearish breakout through L4, then L5 becomes your target. Keep in mind that the fifth layer of the indicator can have varying formulas, depending on which version of the equation you find.

The first and second layers of the indicator (L1, L2, H1, and H2) are typically ignored and generally not even plotted. However, I will explain the best times to use these “hidden layers” in a future blog post.

Advanced Calculator With Fractions

Take at look at the 5-minute chart of MasterCard, Inc. (ticker: MA) for a brief diagram of the types of opportunities you can find using the Camarilla Equation.

Advanced Camarilla Formula

Remember, this is a very basic look at the Camarilla Equation. Much like the other forms of price-based indicators I use, the Camarilla Equation lends itself perfectly for higher levels of analysis, like pivot width analysis, pivot trend analysis, and two-day pivot relationships. I’ll break these concepts down in future blog postings.

Now that the cloak has been removed, what do you think?

Camarilla Advanced Calculator Formula 1

Camarilla Advanced Calculator Formula Chart

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss